File Tax Returns for A.Y. 2019-20 before 31st March with INR 10,000 Penalty

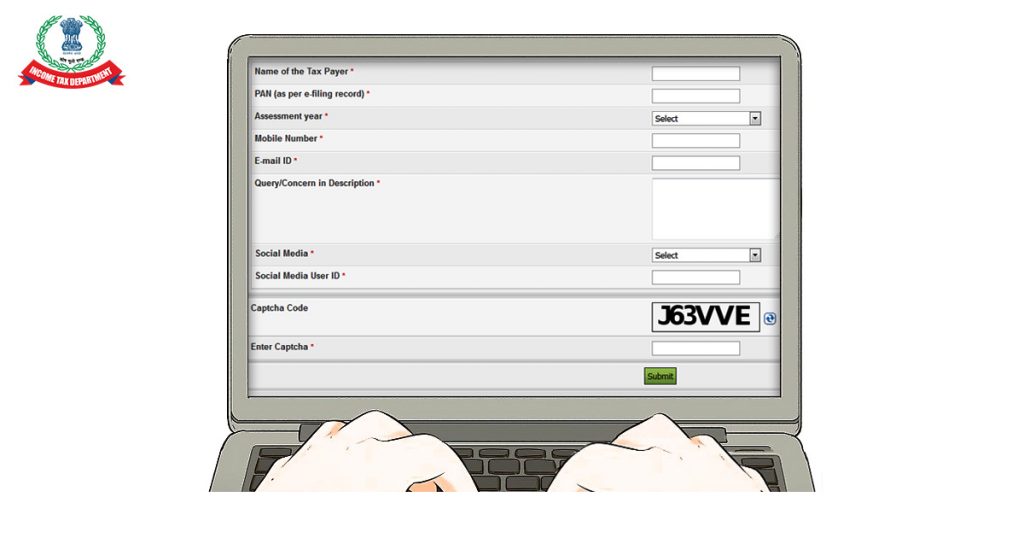

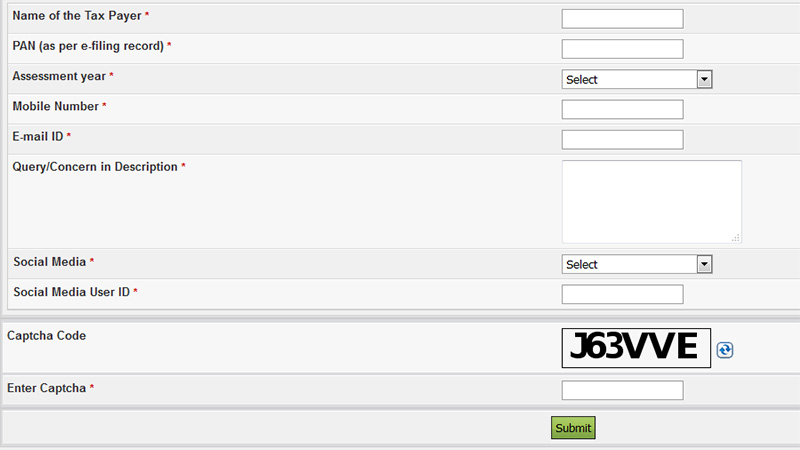

The income tax department notified the taxpayers for late filing of tax returns for A.Y. 2019-20, along with a penalty of INR 5000 (on filing the return after the due date but on or before 31st December) and INR 10000 (on the filing of return after 31st December to 31st March). The taxpayer has to file the late filing of tax returns for A.Y. 2019-20 before 31st March anyhow. Also to note that the penalty is applicable even if the taxpayer files the returns before 31st March while there is no option to file the returns after 31st March 2020.

Last Date of Income Tax Return Filing for AY 2019-20

(Assessee who are required to furnish report under sec 92E)

- Due date of filing the Income Tax Return by Assesse who are required to furnish report under sec 92E is 30th November 2019.

Advance Income Taxes Filing Due Dates FY 2018-19

If the tax liability is more than Rs 10,000 in a financial year then advance tax needs to be paid by the assessee.

15th June (15%) | 15th Sept. (45%) | 15th Dec. (75%) | 15th March (100%)

The assessee who are covered under section 44AD, are also required to pay the advance tax on or before the 15th march of the previous year.

- A Company

- A Person (Other Than a Company) whose accounts are required to be audited under this Act or under any other law for the time being in force, or

- A working partner of a firm whose accounts are required to be audited under this Act or under any law for the time being in force

What is the Income Tax?

There are two types of tax levy one is direct tax second one is an indirect tax. Income tax is a direct tax which is directly attributable to the income of the assessee. Income which is generated from the various head of income viz.Salary, House Property, Business, Capital Gain and Income from other sources. The assessee has to pay Income tax if his total Income after allowing Chapter VI-A Deduction is more than the taxable income limit.

Filing Income Tax Return Due Dates for FY 2018-19 (AY 2019-20)

There is a different category of taxpayer viz. Individual, HUF, Firm, LLP, Company, Trust and AOP/BOI. Due Date is different according to audit or non-audit case of such categories as defined in section 139(1)

Last Date of Income Tax Return Filing for AY 2019-20 (Non-Audit Cases)

- Due date of filing the Income Tax Return by Assesse whose Books of Account are not required to be audited is 31st July 2019. The income tax department has extended the due date till 31st August 2019. Notification here

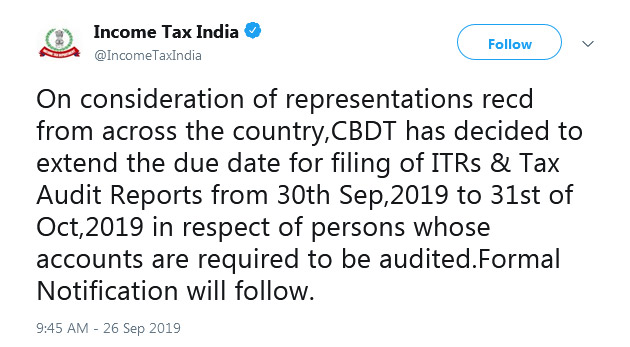

Filing Income Tax Return Due Date for AY 2019-20 (Audit Cases)

The due date for filing the Income Tax Return by Assesse is 30th September 2019.

Note: “On consideration of representations recd from across the country,CBDT has decided to extend the due date for filing of ITRs & Tax Audit Reports from 30th Sep, 2019 to 31st October 2019 in respect of persons whose accounts are required to be audited. Formal Notification will follow.” as Income tax department tweeted on 26th September.