After uploading of return in electronic mode, a New functionality of electronic verification code (EVC) of the Income Tax return has been introduced vide Notification No. 2/2015, dated 13/07/2015. This facility can be used as an alternative for submission of ITR-V to CPC- Bangalore.

Mode and Process of Generating and Validating IT Returns through EVC

- Through Aadhar Number

- Generation of EVC on mobile or e-mail

- a) Through Net banking

- b) Through Email id and Mobile Number

- c) Through Bank Account Number

- d) Through Demat Account Number

- e-Verify through available EVC

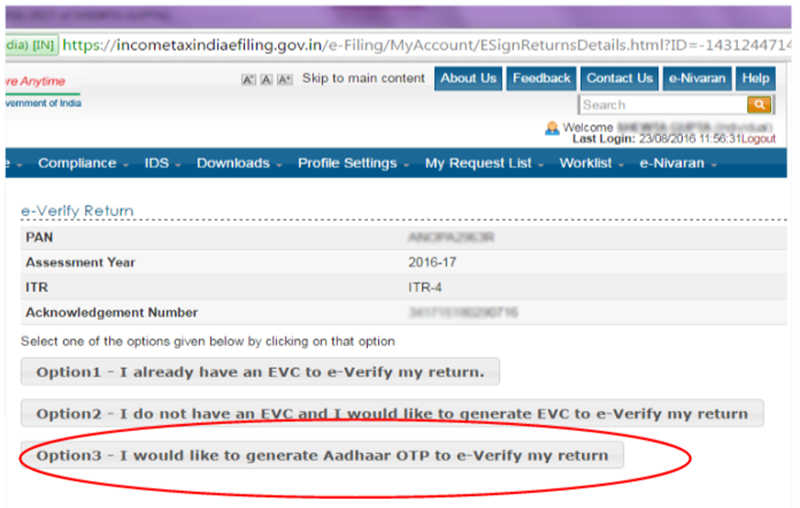

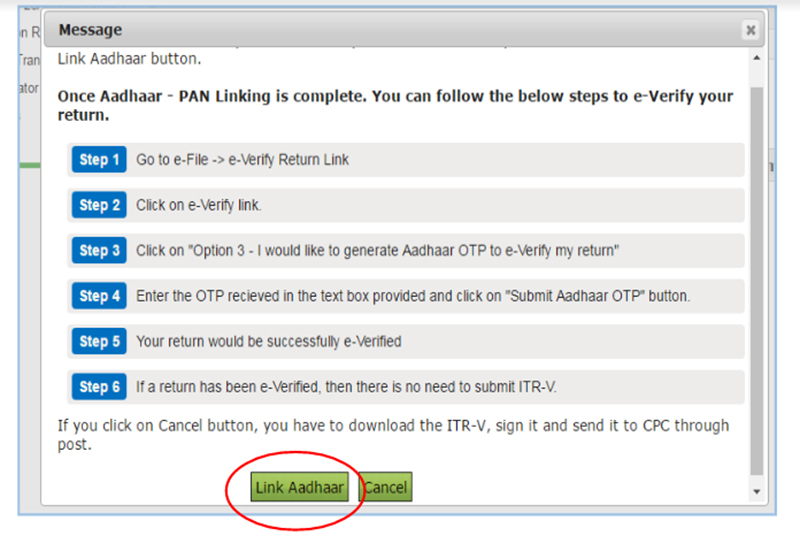

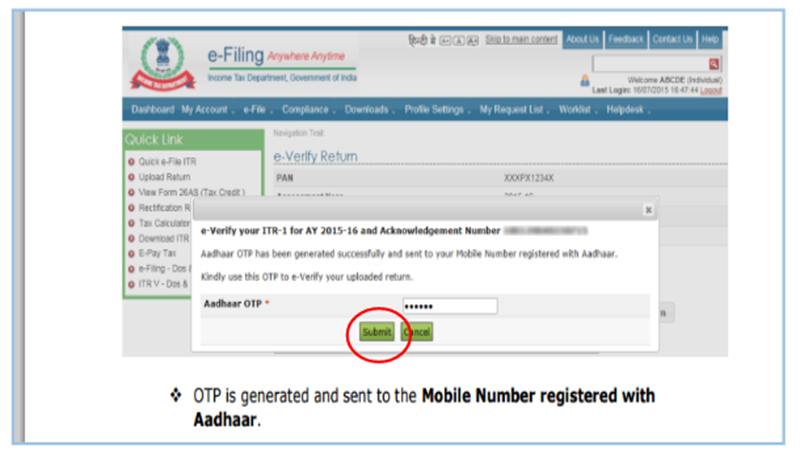

Through OTP Generated by Aadhar Card Linking

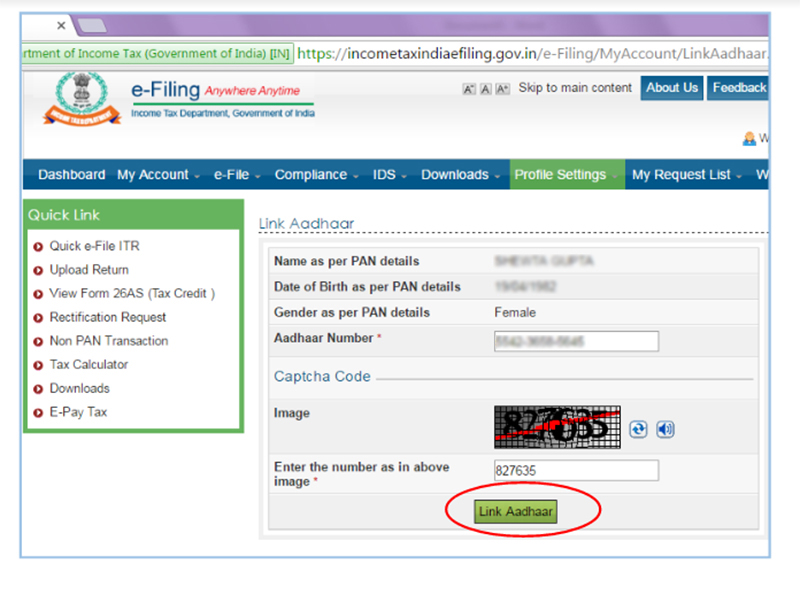

If the assessee has Aadhar Number then he has to link Aadhar No. by Clicking on “Profile Setting” on ITD portal and then click on Link Aadhar Card.

Step 1

Step 2

Step 3

Step 4

Step 5

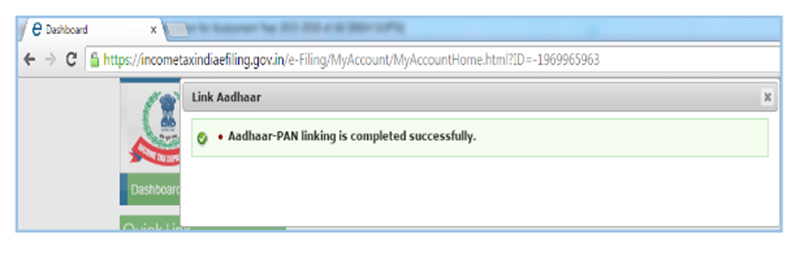

After successful linking of Aadhaar Number, you can e-verify your return through Aadhaar OTP

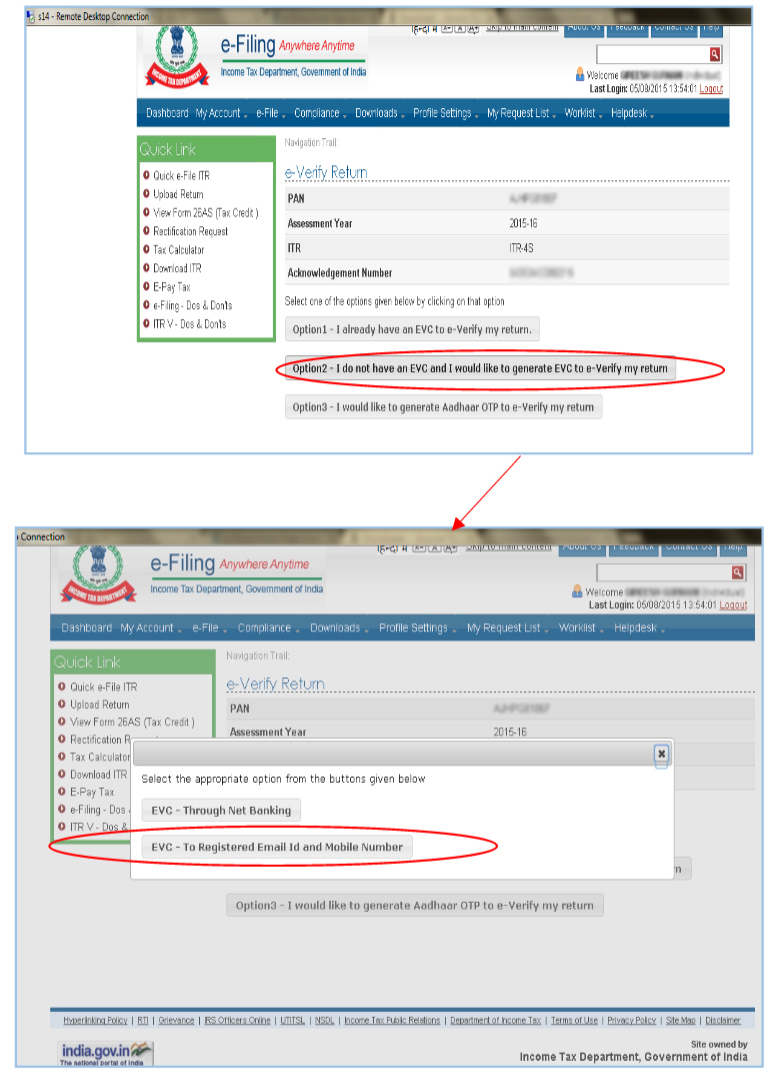

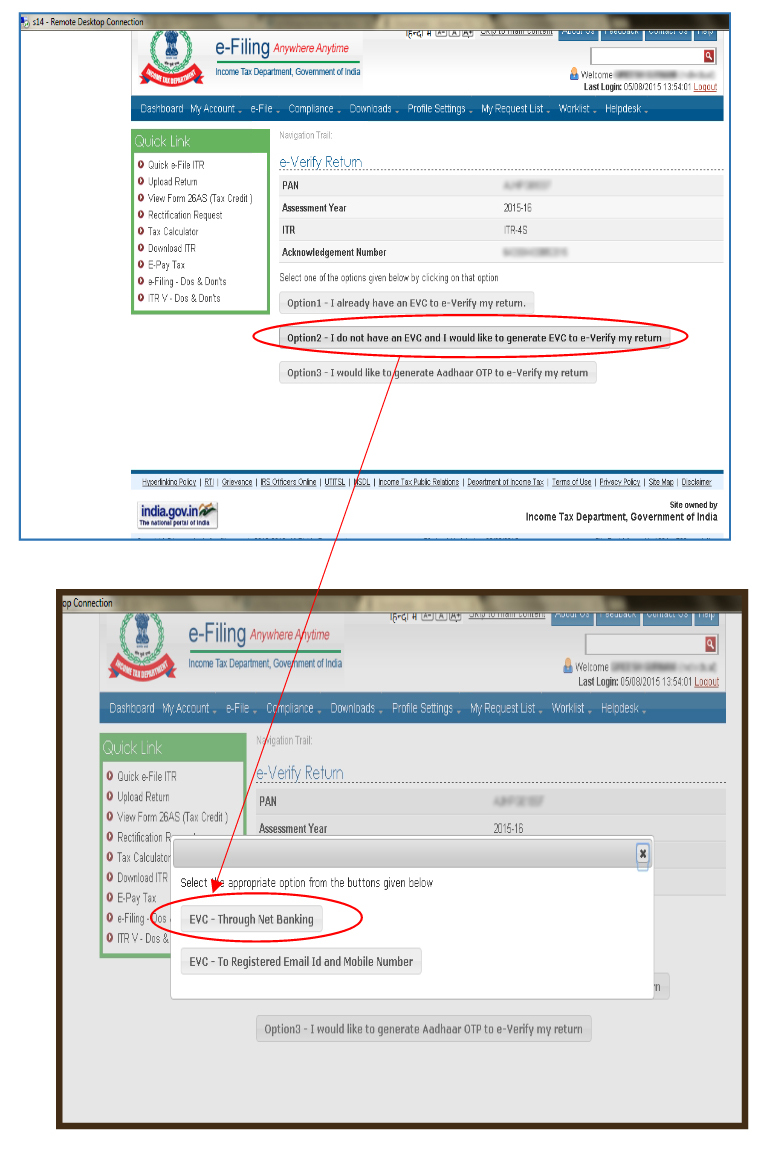

2. I do not have EVC and I would like to Generate EVC to e-Verify My Return

After uploading of return in electronic mode assessee has to choose an option from e-Verify drop-down option.

“I do not have an EVC and I would like to generate EVC to e-verify my return” by clicking on this option four modes will be available:

- EVC —> Through Net banking

- EVC —> To registered Email id and Mobile Number

- EVC —> Through Bank Account Number

- EVC —> Through Demat Account Number

Note:

- A) In case of refund claimed in uploaded return, the user can generate EVC through Internet banking not on registered Email Id and mobile No.

- In Case Assessee’s Total Income is more than five lakhs Rs he will not be eligible to e-Verify his return through registered Email Id and mobile No

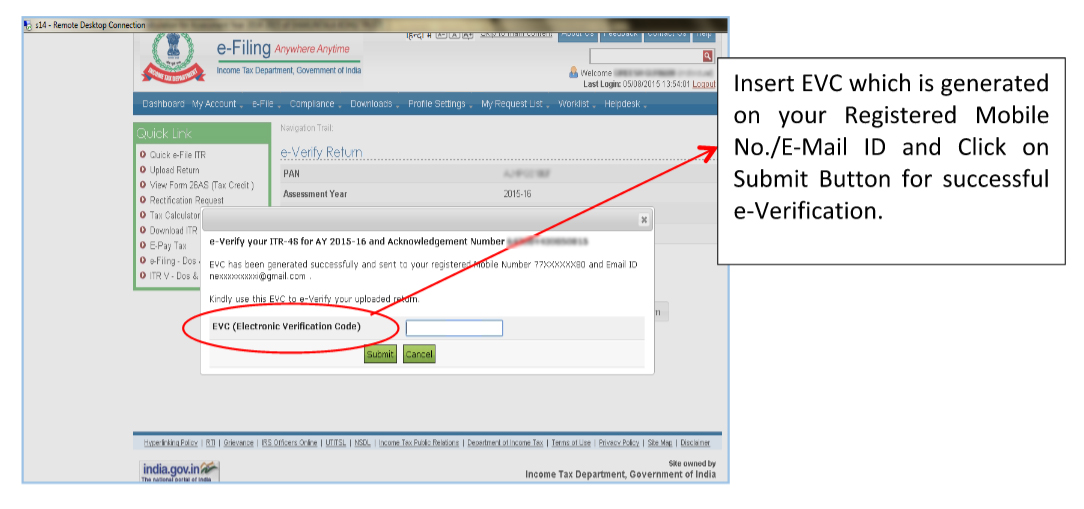

EVC —> To registered Email id and Mobile Number

After selecting this option a code will be sent by ITD to registered mail id and Mobile No. The assessee has to submit this code for e-verification.

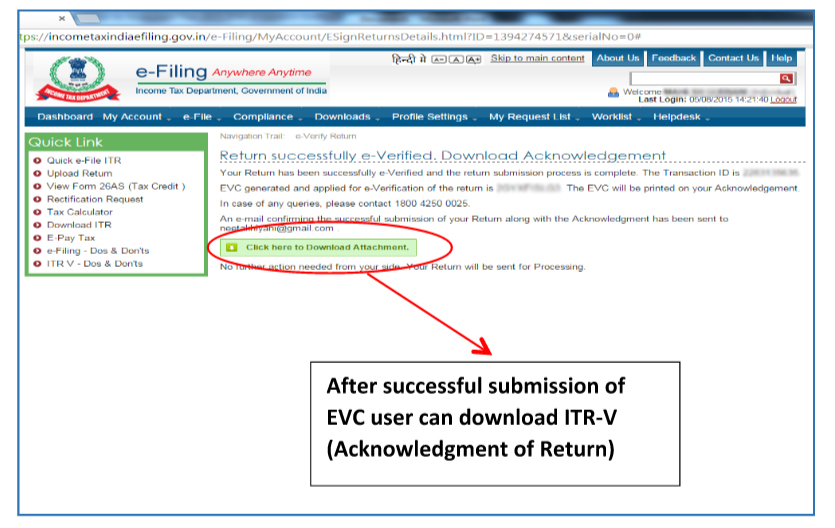

After Submitting EVC, the user can download ITR Acknowledgment

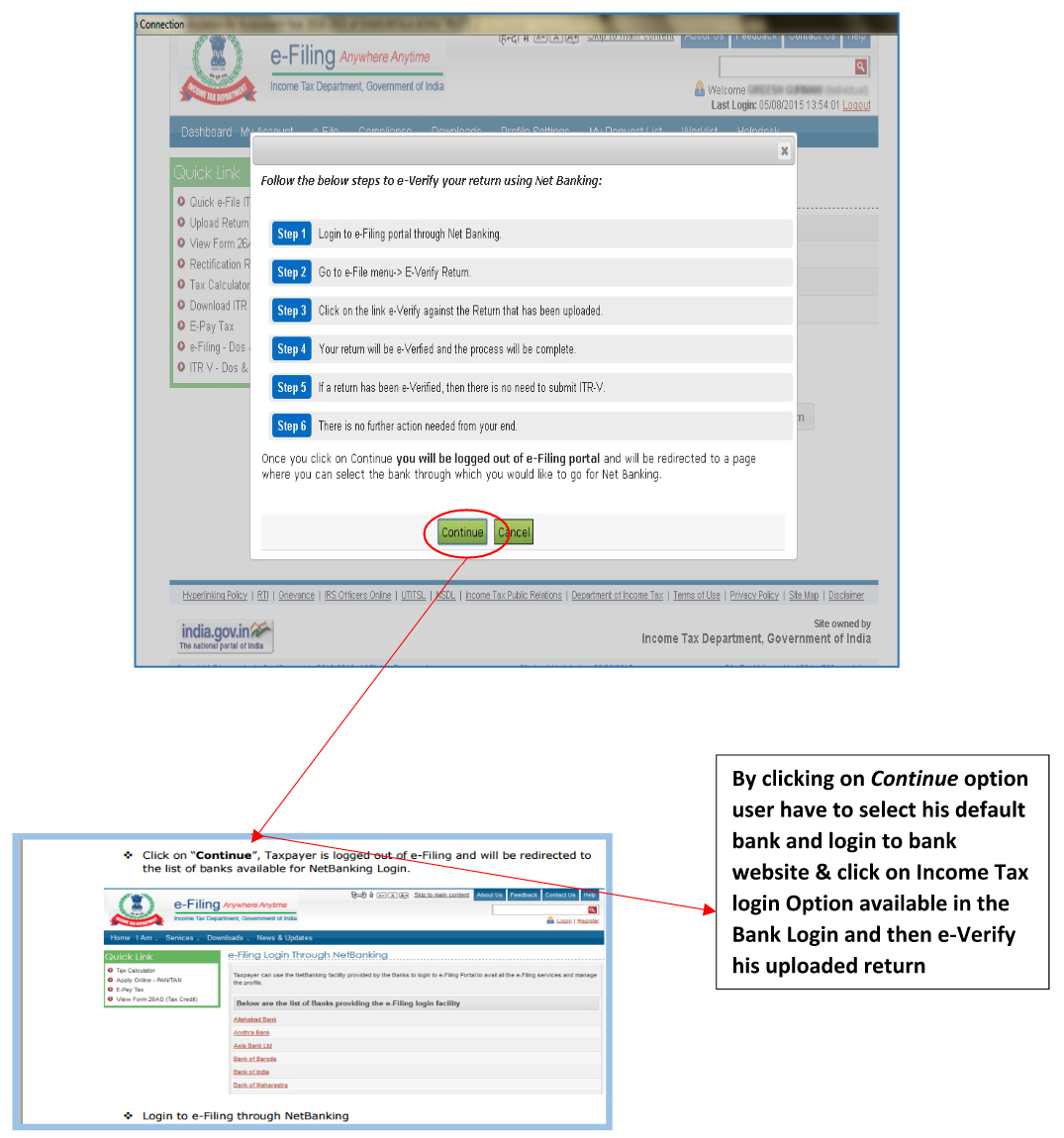

EVC —> Through Net banking

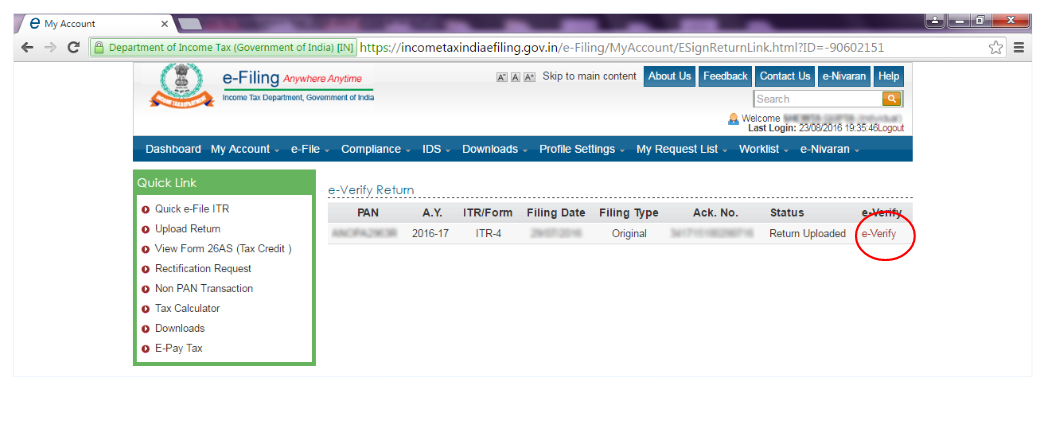

Step 1 —> Go to ITD Login —> View Return Form —> Click on e-Verify option

Step 2 —> By clicking on that option following screen will be appeared

Earlier there were only two options, EVC through Net Banking or EVC through Email Id and Mobile Number

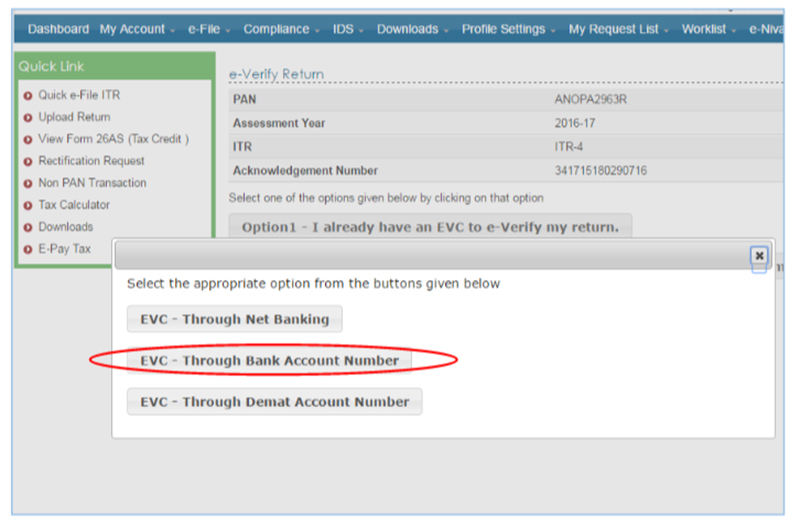

The Assessee who don’t have Internet banking facility can verify their return through Prevalidating Bank Account Number.

But for this function assessee must have the bank account in Punjab National Bank, State Bank of India, ICICI Bank or United Bank of India, then the only assessee can e-Verify return.

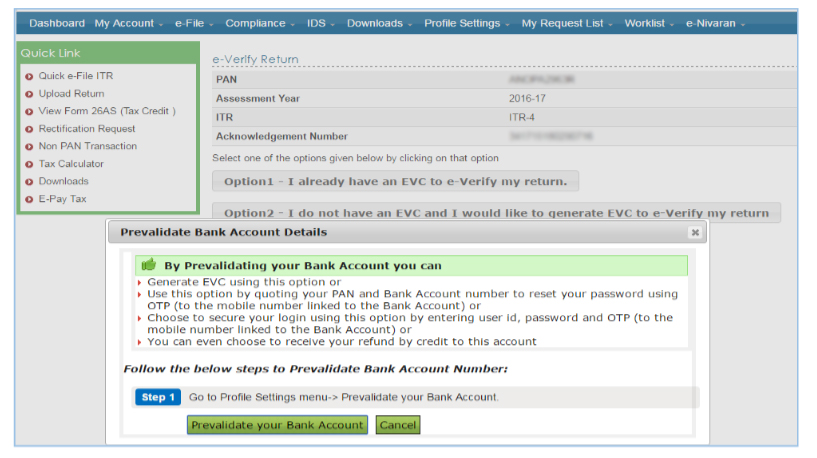

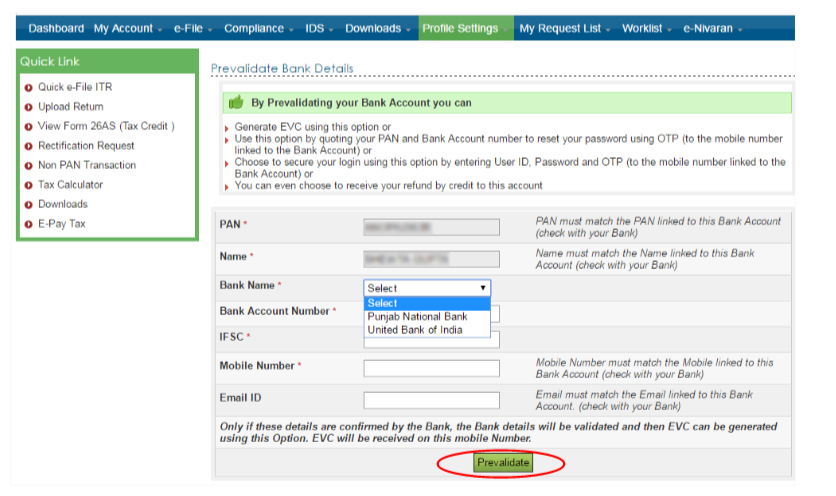

Generation of EVC through Bank Account Number

Step-1

Step-2

Step-3 —> Assessee have to fill all the required Details like Select Bank from the drop down box Fill account Number with IFSC code and Mobile Number and Email Id and click on Pre-validated Button

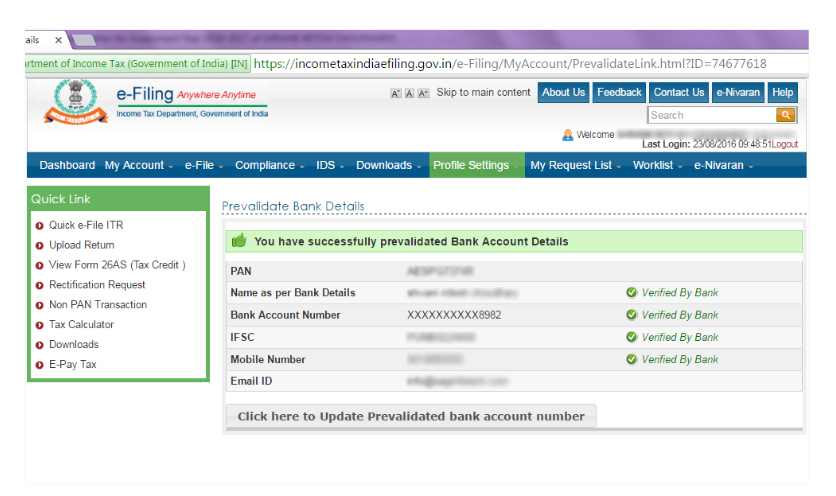

Step-4 —> Successful Pre-validation of Bank Account Number

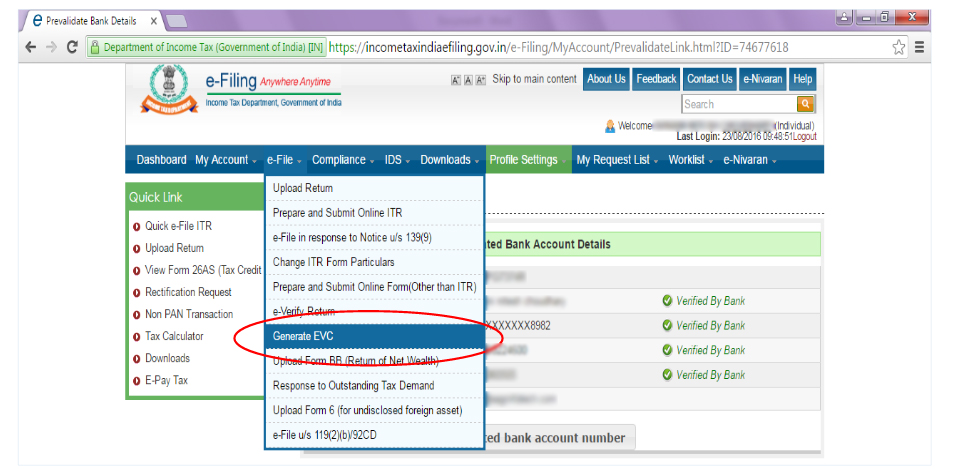

Step 5 —> Generation of EVC to e-verify ITR

After successful Validation of Bank Account Number, assessee have to click on Generate EVC option in e-file Menu of ITD login and he will get a code on his registered mobile Number. After furnishing code return will be e-verified by ITD.

EVC generation Through Demat Account Number:

If you have Demat Account Number then you can use this facility to e-Verify your return.

For this function you have to follow such simple steps:

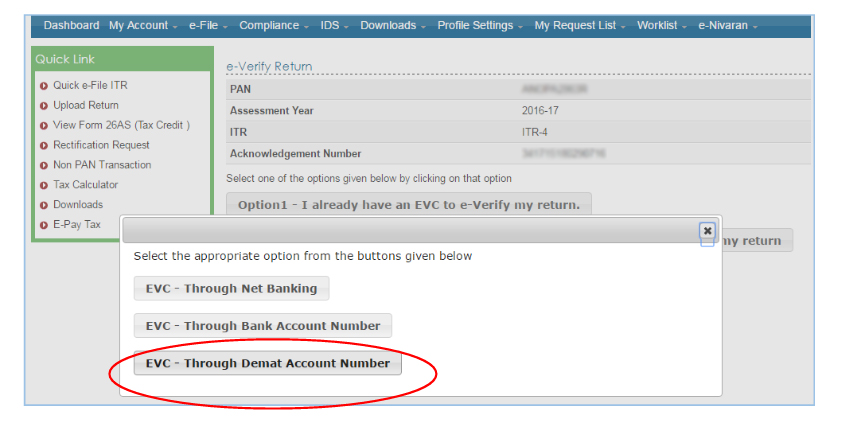

Step 1 —> Login to e-filling website –> Click on View Return Form and select e-verification option.

Step 2 —> Choose Generate EVC through Demat Account Number from available options.

The following screen will be available.

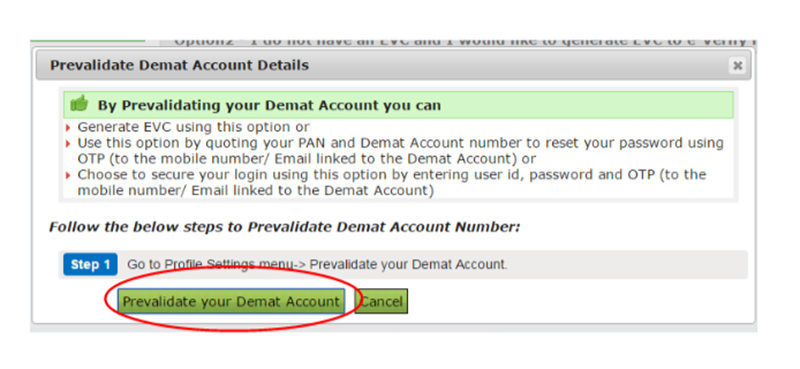

Step 3 —> After selecting Demat Account option user have to pre-validate his Demat Account Number

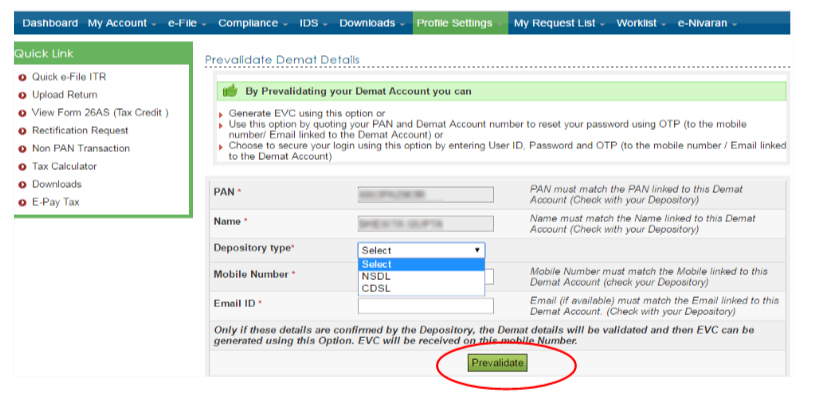

Step 4 —> Fill following particulars to verify your Demat Account Credentials and click on Pre-Validate option after submitting details user have to select Generate EVC like assessee has done in step-5 then return will be E-verified.

Recommended: