Filing GST is a massive task involving document compilations, computations, GST calculations, verification and so on. People with deficit knowledge are often seen struggling with GST filing and reviewing the documents for accuracy.

GST invoice is one of the major components used while computing tax, one wrong invoice will affect the figures in GST returns leading to more tax outgo. The particular write-up highlights the importance of revising tax invoices under GST and how to revise a GST invoice for its accuracy.

GST Invoice Tax Introduction

A GST Invoice is basically an electronically generated supply bill issued at the time of goods or service trades. Indexed in a proper GST invoice are issue date, HSN code of the product, SAC code, SGST, CGST, IGST amounts and the final taxable value of the goods and services sold. One must fill all the details accurately in order to get the exact amount of tax that has to be paid and also the amount of credit that has to be availed.

Revising a GST Tax Invoice for Accuracy in Figures

There are probabilities of issuing a wrong GST invoice which if not modified will lead to inappropriate tax outgo. To escape such cases revision of the invoice is needed.

While revising an tax invoice taxpayer may consider:

- Downward revision in prices of goods and services that are supplied.

- Upward revision in prices of goods and services that are supplied.

- Changes in GST rate and so on.

Upward revision of the invoice is possible via a Supplementary invoice and Downward revision can be done via a credit note. In some cases, there is a complete revision in the invoice hence a revised invoice is issued.

Currently, there are no rigid provisions for the revised invoice under GST laws. Registered taxpayers operating in the country are assigned a GSTIN number. Following the completion of the necessary formalities, taxpayers will be assigned a formal registration number under GST.

Starting from the date of execution of GST till the registered dealers getting a formal GST ID number, issuing a revised invoice for every billing is a must. The tax invoice must adhere to the terms of GST and is mandatorily be issued within 30 days from the day of issuing the original registration certificate.

It is quite obvious from the above sentence that no revised invoice shall be considered valid after issuing the registration certificate to the registered taxpayers. Gen GST Billing Software caters to all the invoice related requirements of the taxpayer (small or large businesses).

Understanding Supplementary GST Invoices

Original receipt/invoice may lack certain parameters but the supplementary GST invoice is efficient in every field. There are occurrences where the original invoice lacks details of the taxable value of goods and services supplied. Such is the case when Supplementary Invoices are referred for correct knowledge. Supplier must generate the Supplementary invoice to accumulate such additional changes. SI includes debit and credit notes, hence serving both upward and downward revisions.

No format is pre-defined by the GST Law for supplementary invoices still there are certain headings that are required to be mentioned in such invoices. Particulars are as follows:

- Valid details of the Supplier’s name and address

- Supplier’s GSTIN

- Nature of invoice, i.e. “Debit Note,” “Credit Note,” “Revised Invoice” or “Supplementary Invoice.” must be mentioned in bold.

- The invoice must be written in an alpha-numeric serial number, particularly as per the accounting year

- The date of issuing the invoice.

- Name and address of the Recipient

- Recipient’s GSTIN

- In case if the customer is an unregistered taxpayer then proper address and place of delivery shall be mentioned along with the State Code.

- The original invoice serial number must be provided for which the supplementary invoice is to be issued.

- The differential amount of tax, the taxable value of the goods or services or rate of tax

- Signature of an authorized person for the physical document, or digital signature for the electronic invoice.

To be Noted: With the help of Supplementary Invoice, one can claim an extra ITC on the tax he is paying to the government.

Understanding Credit Note

In accordance with the current GST law, section 2(35) read with section 24(1), credit note can be issued only if there is an original tax invoice issued for goods and services sold and in case if the tax mentioned in the invoice is more than the tax that is supposed to be paid on the respective supply.

Credit Note is applicable in case if:

- The registered taxpayer issues an original tax invoice for the supply of Goods and Services.

- The invoice displays the amount of tax greater than the actual payable amount

Credit notes fulfill the accounting requirements of a GST invoice correctly adjusting the values and declaring valid tax amounts.

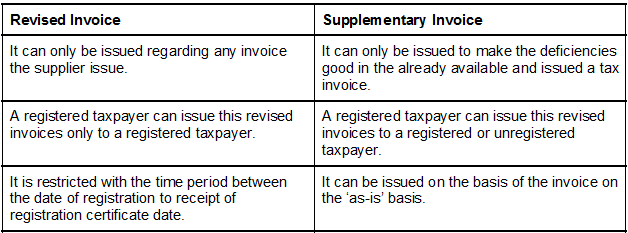

Contrasting Revised and Supplementary Invoice

Revised and Supplementary invoices differ on the following basis.

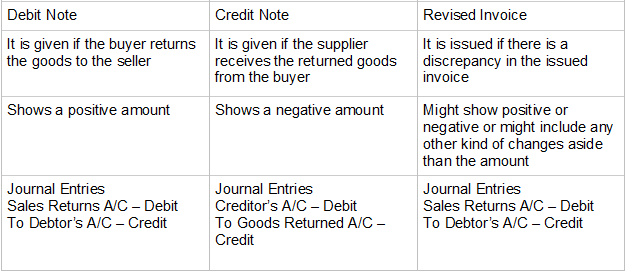

Differentiating Debit Note, Credit Note, and Revised Invoice

FAQs on GST Tax Invoice Revision

Q.1 Return once filed providing all the invoices can be altered? If yes then how can the return or invoice be revised?

There is no such provision of altering already filed returns under GST Law. Amendments can be made in the invoice by issuing the supplementary invoice or credit or debit notes.

Q.2 What is the prescribed time limit for issuing the supplementary invoice by the taxpayer?

Supplementary Invoice should be raised within 30 days starting from the day of receiving the original invoice.

Q.3 Is there any time limit for updating the supplementary invoice in the returns for further computing the taxable value of goods and services?

Supplementary invoices are required to be updated on the GSTN portal on monthly basis. In case of an interstate supply or where the taxable value of the goods and services is less than a hundred and fifty thousand rupees, a consolidated invoice is issued

Q.4 When and where do we need to raise a supplementary invoice?

Circumstances where raising a Supplementary Invoice is mandatory:

- The customer/recipient rejects the goods prevailing low quality.

- Change in the rates of tax.

- If there are amendments in the taxable value of the goods or services.

- If there is a short receipt of materials from the recipient

- If the supplier charges a refund to the supplier

Q.5 I am a recipient of the goods, and I reject the same upon receipt. Will I able to raise a debit note? Is a taxpayer eligible for issuing a debit note in case if he rejects the goods upon receiving them?

It is possible as it is normal accounts but will have no effect under GST. Each credit or debit note issued by a taxpayer have a significant commercial impact. Still, a proper setup is awaited under GST for debit note issued by the recipient.