Tax officials propagated that the Income Tax Department has introduced a modification in the process of issuing refunds to the taxpayer. The department used to issue refunds to taxpayers either in their bank accounts or through account payee cheques, depending on the category of taxpayers. But from this assessment year, tax refunds will be issued only through e-mode, directly in the bank accounts of taxpayers which must be linked with their PAN.

Tax department comes up with this change with the motive of ensuring direct, abrupt and secure tax refund. Bank account linked with PAN is a pre-requisite for this. The bank account can be either savings, current, cash or overdraft.

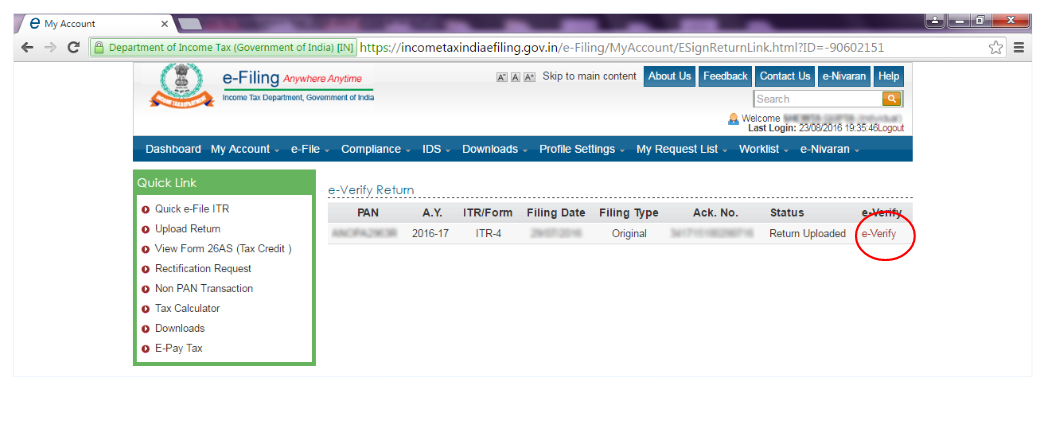

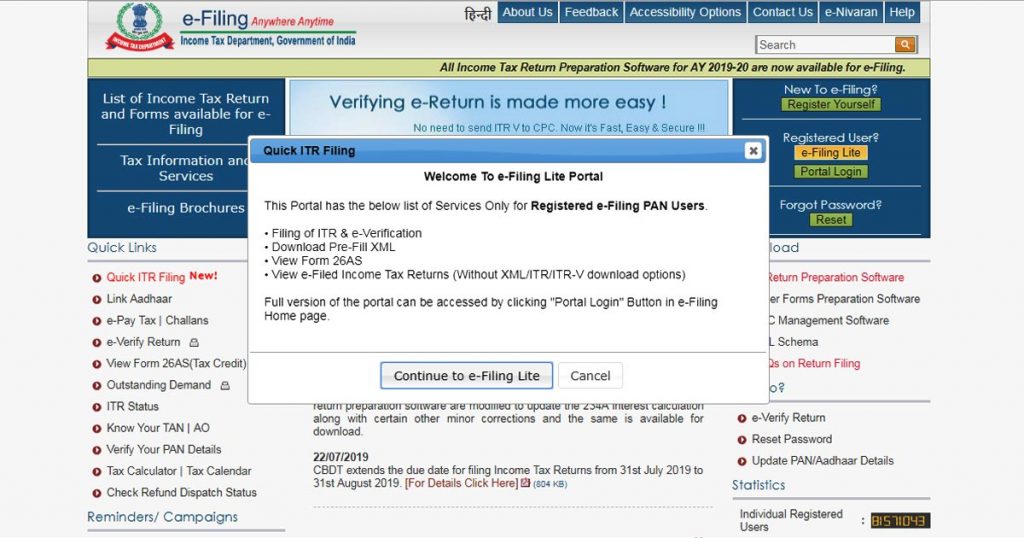

Tax official while communicating with the public also added that taxpayers can make sure if their bank account is linked with their PAN by logging on to the e-filing website of the department: https://www.incometaxindiaefiling.gov.in

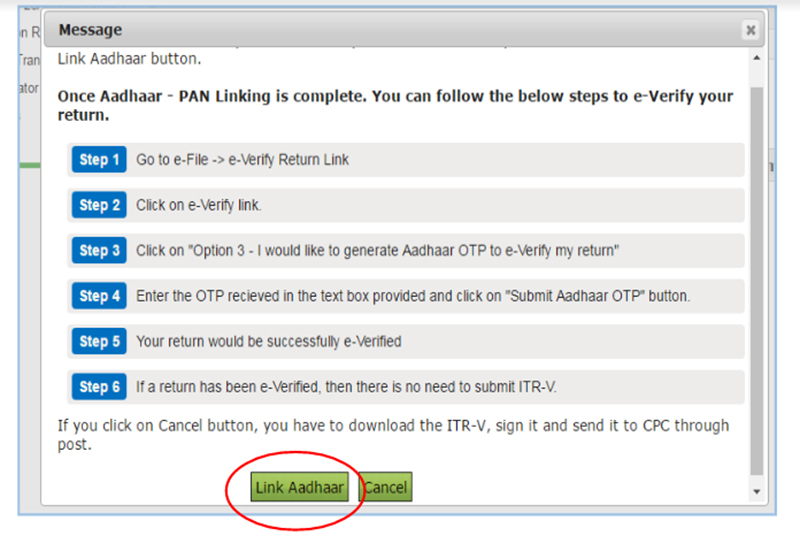

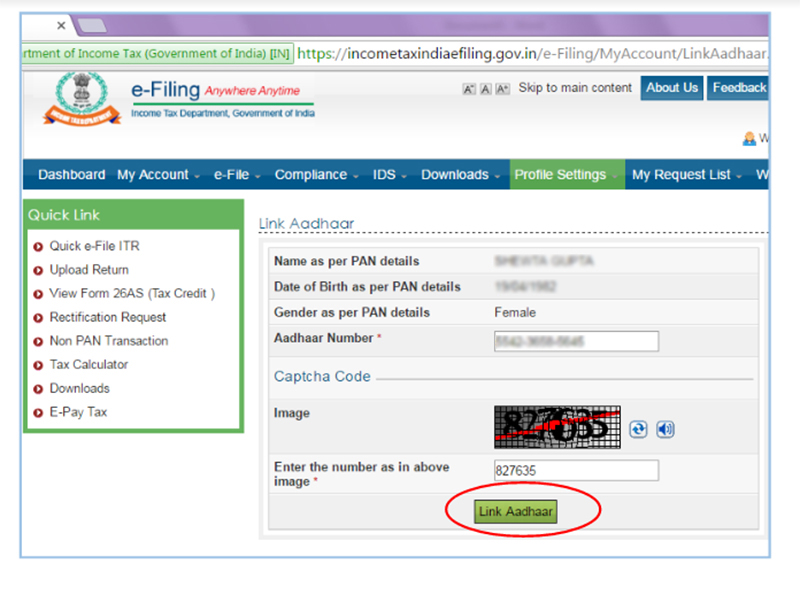

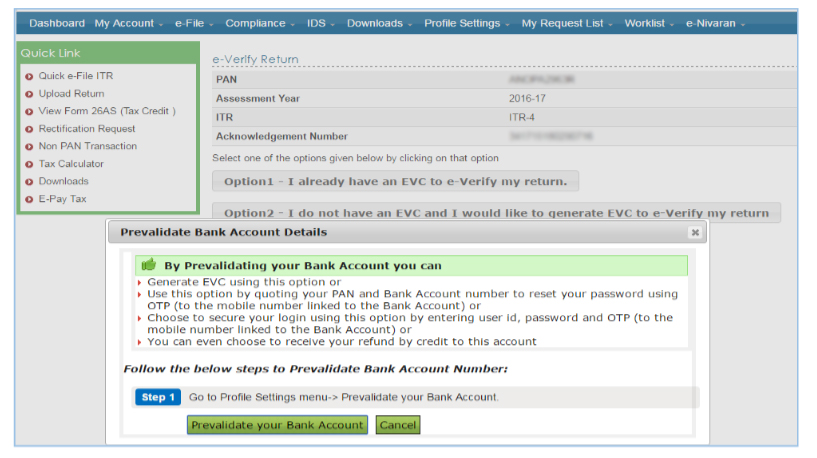

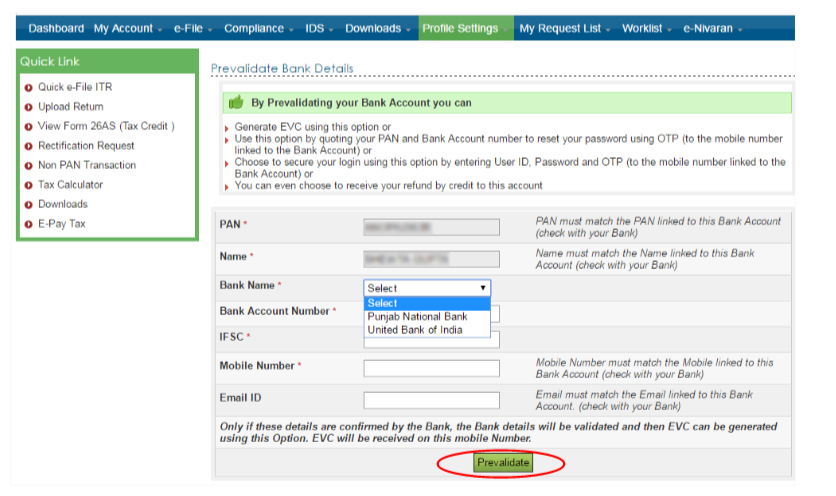

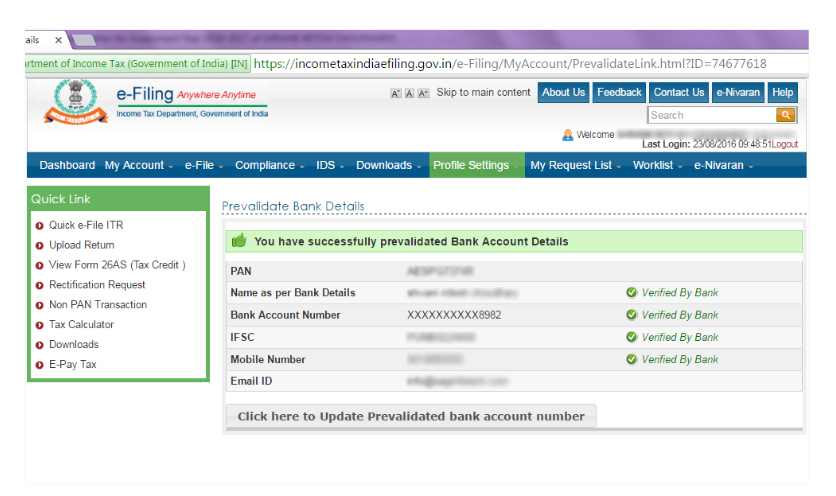

In case the PAN is not coupled with the bank account then taxpayers are required to link it by visiting their home bank branch followed by its validation over the income tax return e-filing website of the I-T Department.

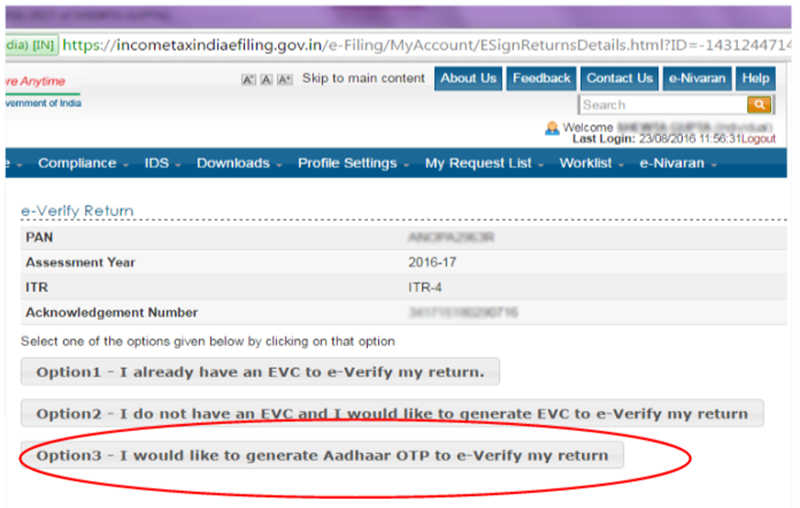

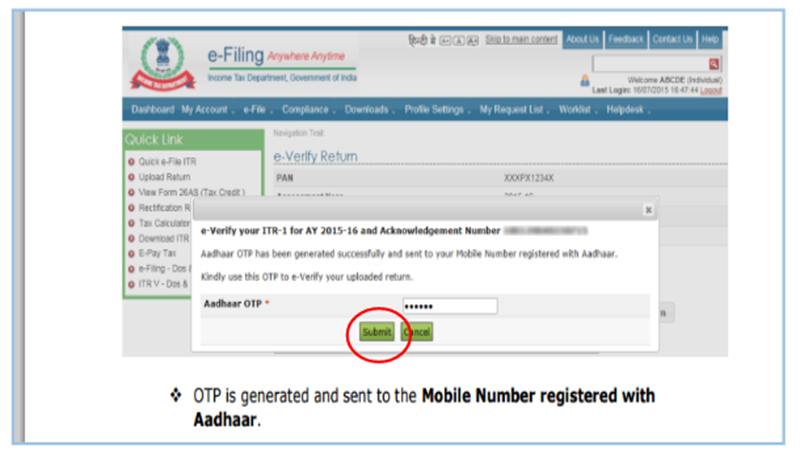

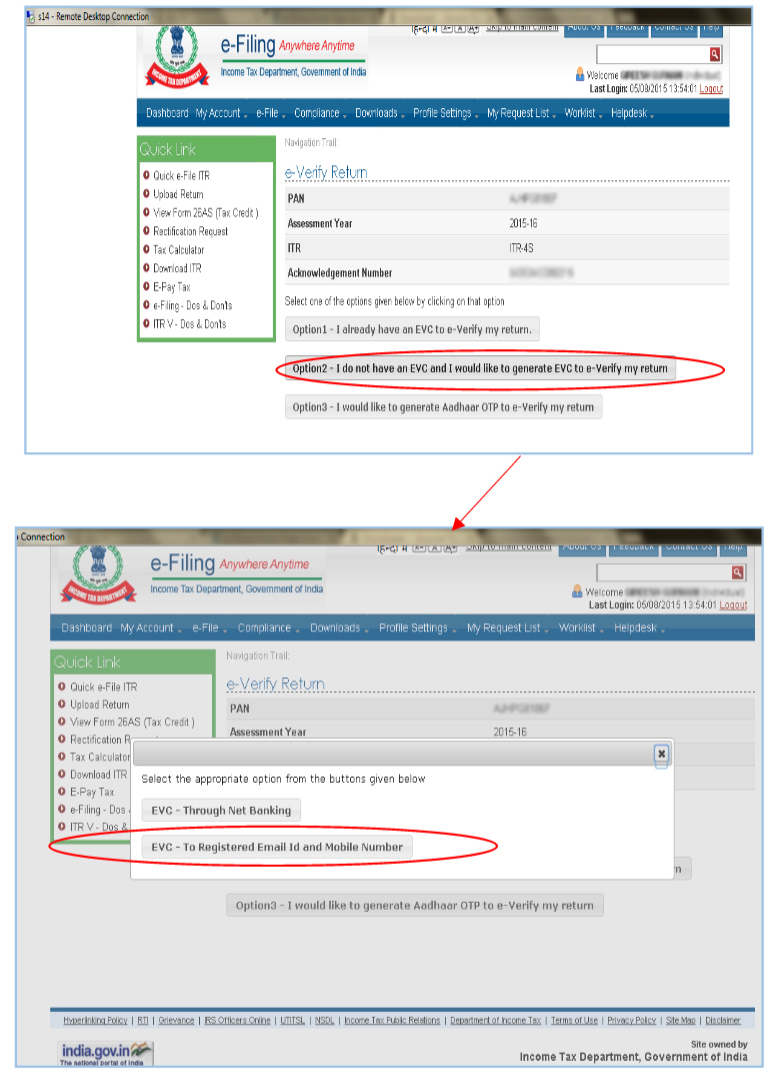

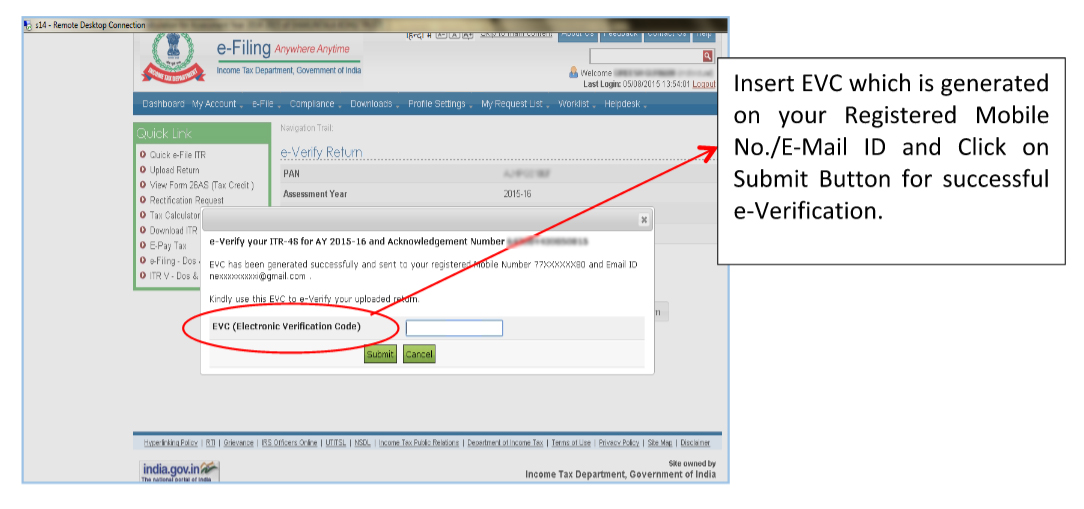

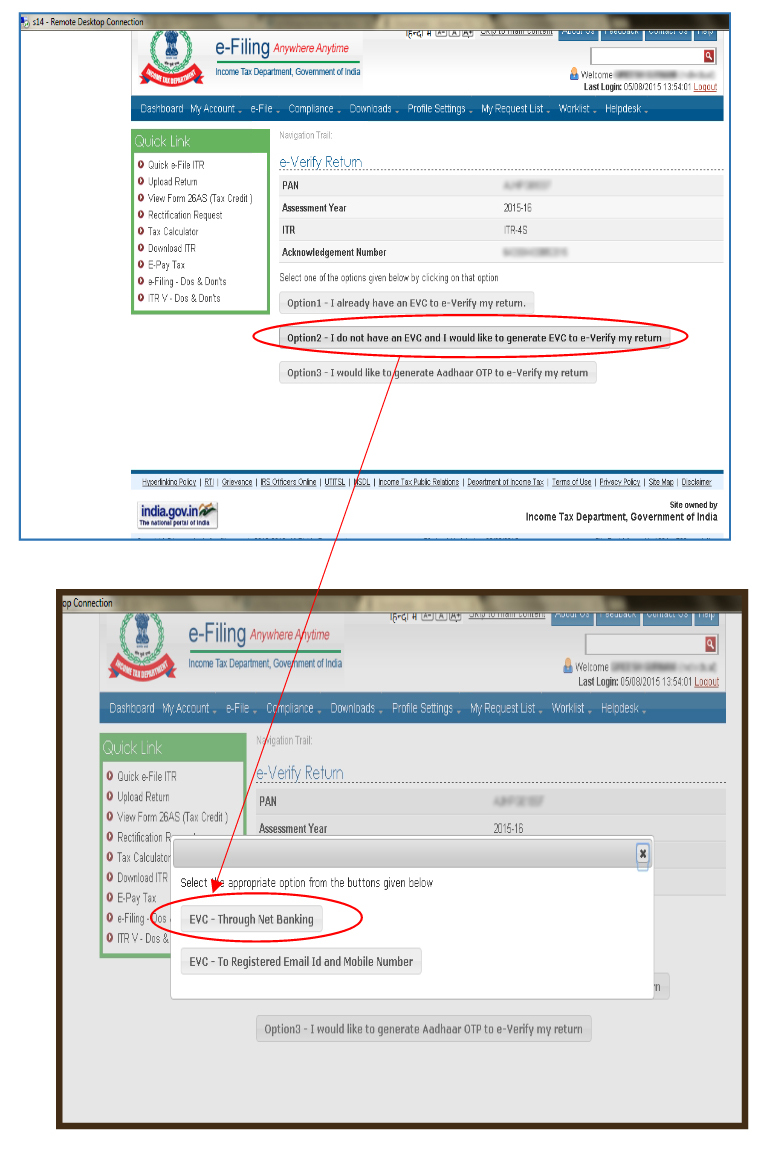

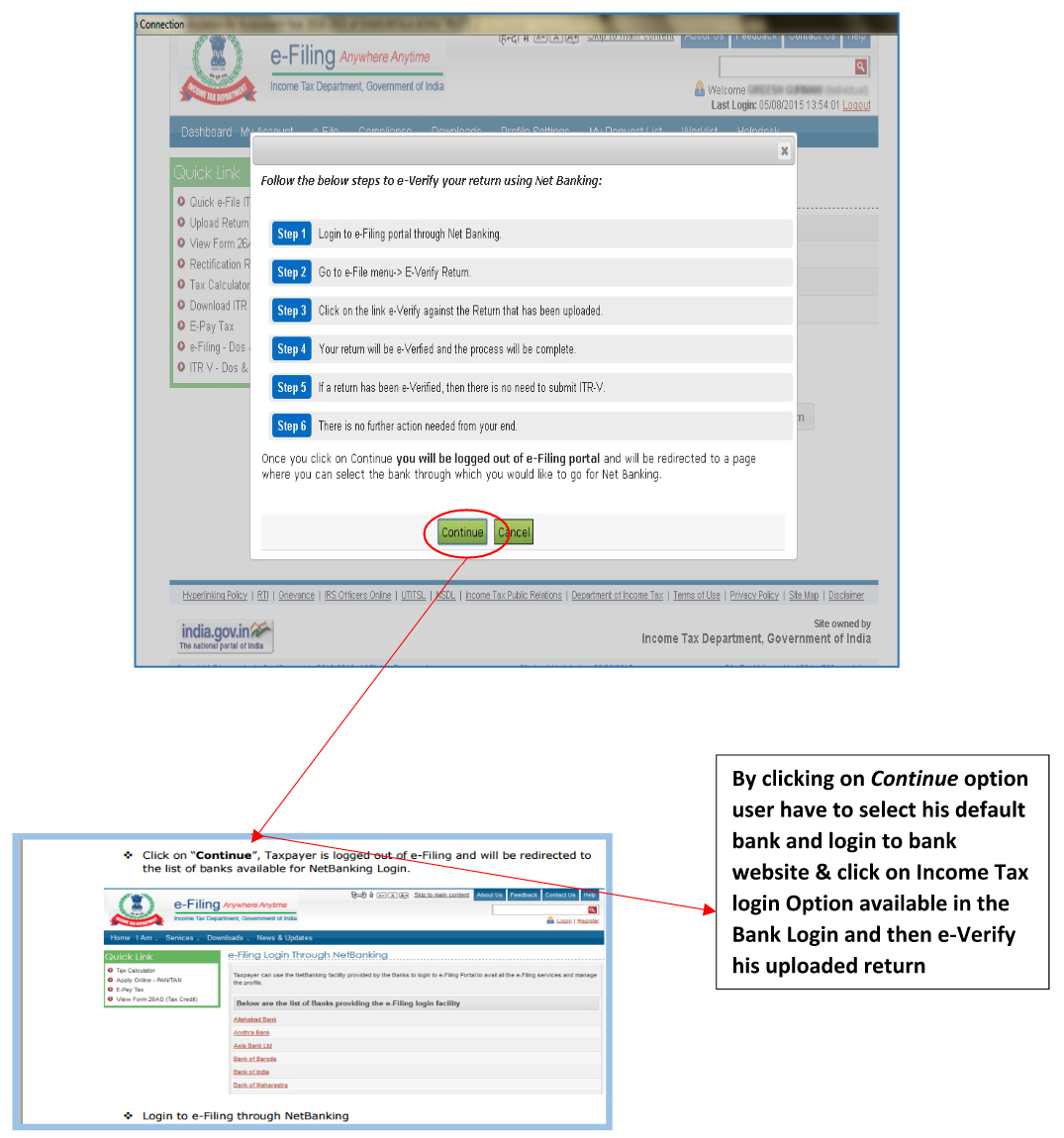

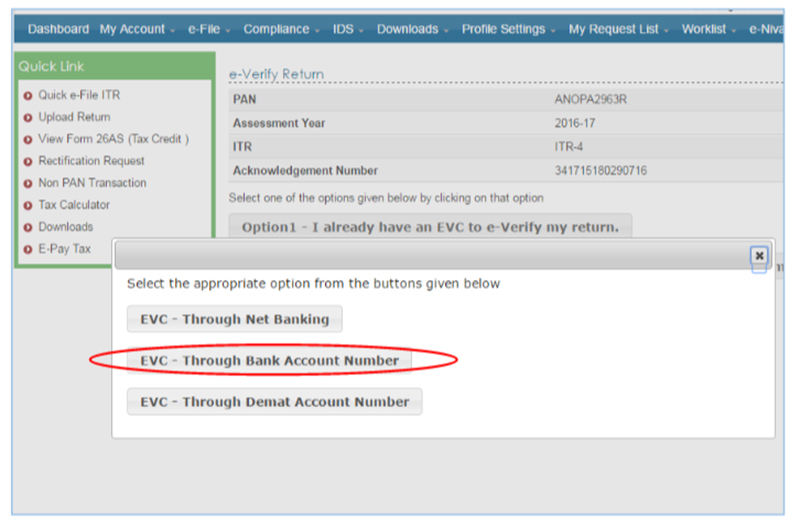

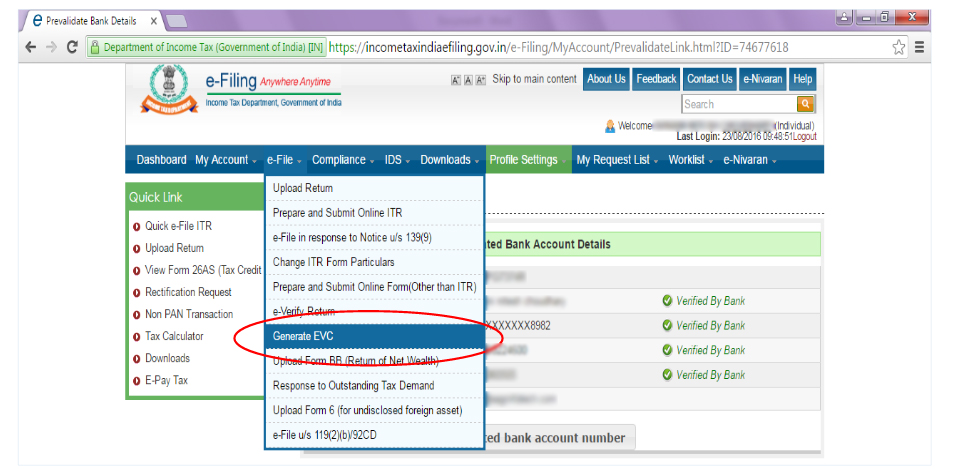

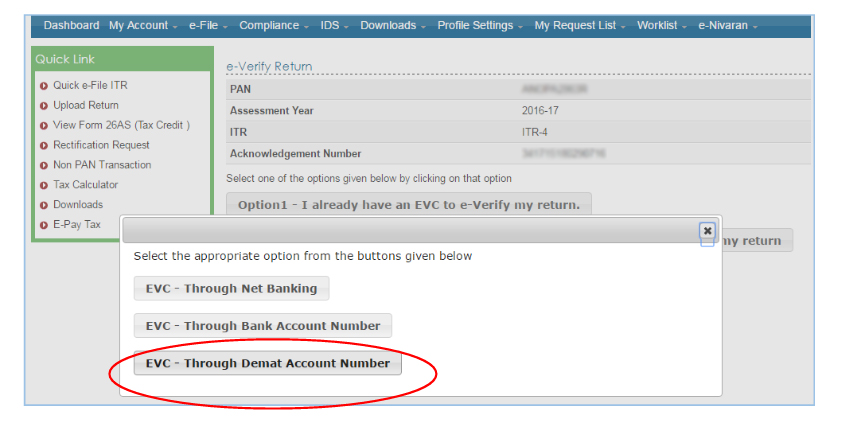

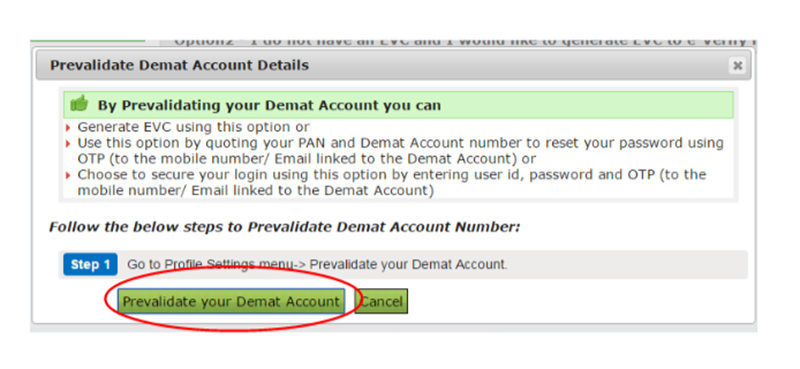

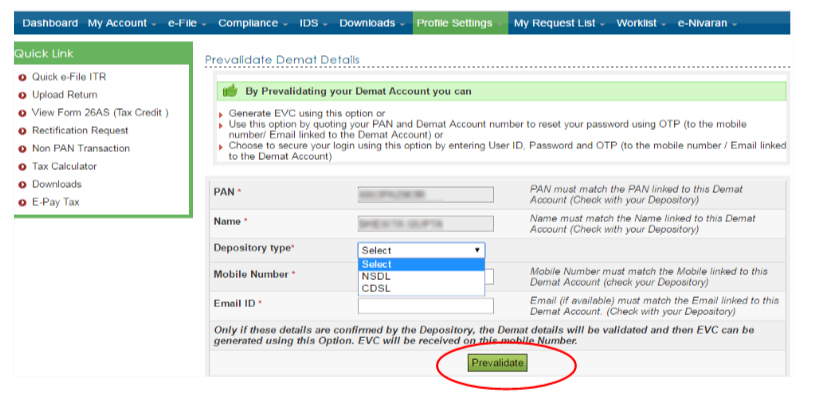

If your bank is unified with the e-filing portal, pre-validation can be done easily & directly via EVC (Electronic Verification Code) and net-banking route. On the other hand, if your bank account is not integrated with the e-filing portal, then the income tax department will certify the bank account itself from the details filled up by you.

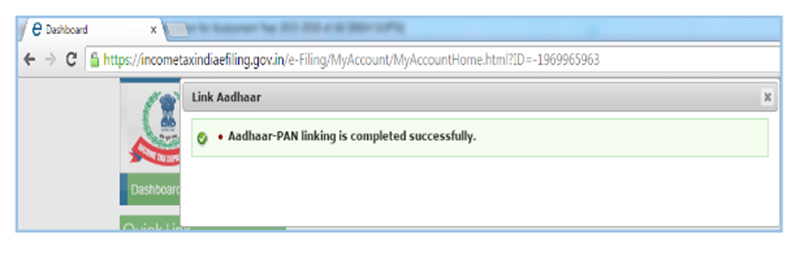

It has also become mandatory to link PAN with the Aadhar-PAN in order to file an ITR (Income Tax Return) and deadline for the same is 31st March 2019.

PAN is a 10-digit alphanumeric number allotted by the IT Department to a person, firm or entity. Aadhaar is assigned by the Unique Identification Authority of India (UIDAI) to an Indian resident, containing a 12-digit number generated on the basis of some factors like demographics and biometric data specific to each individual.

Read Also: Solved! Name Mismatch Problem (Aadhaar and PAN Card) for ITR Filing?

Aadhaar card is as significant as a PAN card for an Indian citizen

While updating the data at the beginning of this month, the I-T Department witnessed that only 23 crores PAN were linked with Aadhaar and the remaining 19 crores PAN are still needed to be linked.